How Much Money Do You Need Upfront To Buy A House

Home buyers ofttimes focus only on the downward payment when it comes to buying a business firm. Closing costs tin can increase the amount of greenbacks you lot'll need to close. What are those fees, and how much can you await to pay?

One of the biggest shocks of ownership a home is finding out that yous need way more cash to close on a house than but a down payment. It's hard enough to save for the downward payment on your dwelling, only to detect out that you need more – frequently a lot more than – in gild to complete the transaction.

Let'southward look at how much cash it takes to actually purchase a home. And where possible, I'll suggest ways that can reduce or fifty-fifty eliminate the additional cash requirements.

The bodily down payment

This is the only greenbacks outlay in the home-buying process that'south obvious to well-nigh buyers. It is usually expressed every bit a percentage of the buy toll of the property. For example, if the purchase price is $200,000, and you're required to make a 10% down payment, yous'll have to pay $20,000.

That'southward the easy function.

How much do y'all need for a down payment on a house?

It varies. With near lenders, if yous want to avoid paying additional individual mortgage insurance (PMI), you're looking at a xx% down payment. Merely coming up with 20% may exist difficult for many first-time buyers, so mortgage lenders have options with downward payments of ten%, 5%, or – if you authorize for special FHA loans or VA mortgage loans – as little every bit 3.v%.

This is another good reason to shop around for mortgage lenders.

Acceptable sources of funding for a downwardly payment

Exactly where your down payment funds come up from will depend on the type of mortgage you are applying for. In some cases, the down payment must come from your own funds, such every bit your banking concern account. But in other cases, it tin come from a gift or even be borrowed from canonical agencies.

Conventional and jumbo loans tend to have the strictest rules when it comes to the source of your down payment funds. If you are making a down payment of 5% or 3% of the purchase price, the lender will typically desire to see that the funds come from your own financial resources. That can include coin withdrawn from a banking company account, funds withdrawn or borrowed from an employer-sponsored retirement plan, or even the sale of a personal nugget.

Typically, once y'all satisfy the "own funds dominion", the guidelines become more relaxed. For example, if you're making a 10% down payment, the lender may crave 5% coming from your own funds, and five% from a gift from a relative. Just if the gift is equal to at least 20% of the purchase cost of the property, the lender won't require you to show evidence of your own funds at all.

FHA loans have a more than relaxed view of down payments entirely. Not only can the downward payment come from either your own funds or from a gift, but they besides allow loan proceeds from canonical down payment aid programs. It can make it possible to become 100% financing on an FHA loan.

With VA loans, the down payment isn't typically an effect. VA loans normally provide 100% financing, which makes the down payment a moot point.

Where yous c an't grand et downwardly payment funds from

2 generally prohibited sources are greenbacks and unsecured loans.

By cash, I mean currency you lot store at dwelling house or in a safe. Any coin you invest into a home has to pass through a financial establishment to be considered a legitimate source of funds. In improver, cash savings in the form of currency can't be verified as being valid.

Unsecured loans are a no-go. If yous have any ideas to provide a downward payment from a credit carte du jour accelerate or the proceeds of a personal loan, this volition be rejected by the lender. Not but does it indicate an inability to accumulate funds for the downwards payment, but information technology likewise creates an additional debt obligation.

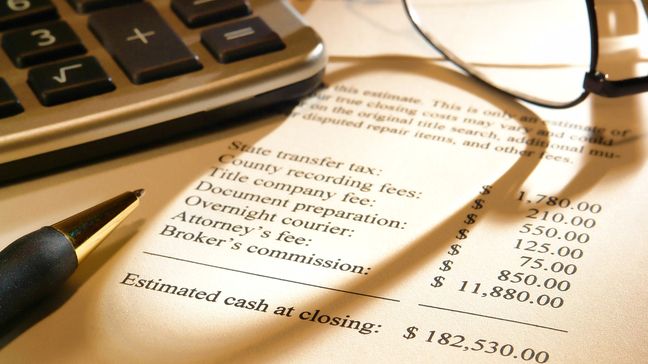

Closing costs

This is where things beginning to become a little complicated. This is because the cash outlay to make the purchase becomes (frequently) much college than the downwardly payment alone.

Closing costs may stitch to 2%-3% of your loan corporeality

On a $200,000 mortgage, you'll need to come up with between $4,000 and $6,000 in addition to your down payment.

Closing costs vary from one country to another. This is due to differences in either the real estate transfer tax, or mortgage "stamps" (regime taxes collected based on a per centum of your mortgage loan amount). They can also vary based on dissimilar rates charged for appraisals, attorneys, and even title insurance.

Closing costs tin can also vary from one lender to another, and even from ane loan to another. For example, each lender charges a dissimilar application fee. In add-on, lenders often accuse "points" – so named because they represent a percent indicate of the loan amount.

An origination fee is one kind of bespeak.The charge will by and large be betwixt 0.5% and 1% of the new mortgage amount. Information technology represents compensation to the lender for placing the loan. Disbelieve points are another blazon. They stand for points paid to lower the mortgage interest rate on a permanent footing.

For example, past paying a discount fee of 1% of the loan amount you have, you can reduce your mortgage interest charge per unit by approximately one/8 of 1% (0.125%). However, if cash to close is an result, paying disbelieve points to lower the interest rate isn't generally recommended. The small decrease in the monthly payment doesn't normally justify the cost of the disbelieve points paid upfront.

Typical closing costs (other than origination fees and discount points)

Below is a listing of common closing costs, including their purpose and a general toll range. Not all will be charged in every instance, and at that place may be boosted fees specific to your geographic location.

- Awarding fee – Not all lenders charge this fee, but when they do it usually includes funds for both the appraisement fee and the credit report. It will generally be between $300 and $500 if it is charged.

- Appraisal fee – This is the fee the lender will pay to an independent appraiser to establish the market value of the holding you are purchasing or refinancing. It volition more often than not be betwixt $300 and $500 depending on the belongings and appraisal fees in your marketplace surface area.

- Championship search – This is a search done by a title company to determine the existence of whatever liens against the belongings. It's to ensure the holding will transfer with a clear title. The toll of the search is typically betwixt $200 and $300.

- Title insurance – This insurance is purchased to embrace any liens that may not have come out during the championship search. You lot'll be required to have lender'south title insurance to protect the lender confronting any undiscovered liens. But it's strongly recommended that you also get owner's title insurance also, which will protect you if such liens are discovered. With owner's title, you lot'll be able to refinance your home or sell the property even if a prior lien is discovered. The cost of lender's title insurance is usually several hundred dollars, and is based on the value of the home. Owner's title is usually effectually $200.

- Chaser fees – In many states, existent estate closings are handled by title companies. But in others, they're customarily handled by attorneys. Expect to pay betwixt $400 and $ane,000 or more depending on the complexity of your transaction and your geographic location.

- Dwelling inspection – While an appraisal volition be performed to found the market value of the home, it does not accost deficiencies with the holding unless they are obvious. A home inspection is recommended – but non required – whenever you purchase a home. The price volition by and large exist between $200 and $400. But it tin can exist money well-spent if it identifies costly problems that you can have repaired by the seller prior to endmost.

- Real estate transfer and mortgage taxes – Many states impose taxes based on the value of the belongings being transferred or the amount of the mortgage, and sometimes both. It volition typically be a pocket-size percentage of the belongings value or the mortgage amount, and will vary by state and county, and sometimes fifty-fifty by municipality.

There are actually two alternatives that tin either reduce or completely eliminate closing costs:

- Negotiate for the seller to pay your closing costs – This will but be permissible in areas where this is common exercise.

- Negotiate premium pricing with your lender – This is where you pay a higher interest rate on your mortgage in exchange for the lender paying the endmost costs.

Either may be a expert option, specially if you are making a minimum down payment, like 5%, and adding closing costs on meridian would brand your greenbacks outlay significantly higher.

Prepaid expenses

These are probably the almost confusing charges for home buyers, but they are completely necessary. With nigh mortgages, the lender will put real estate taxes and homeowner's insurance in escrow. This means that those charges will be included in your monthly payment, and paid by the lender when due.

In order for that to happen, the lender needs to collect certain amounts upfront, to ensure that the funds are available to make the payments when they are due. The escrow accounts are prepare up to pay the charges on the next due date, while a portion of your monthly payment replenishes the escrow business relationship for the due date after that.

Depending on where y'all live, and the frequency of real manor tax collections, the lender may have to put anywhere betwixt 2 and 12 months of existent estate taxes in escrow. If the taxes on the house are $250 per month, and a six-month escrow is required, that will translate to a prepaid expense of $1,500 at closing.

The same applies to insurance.

For homeowners insurance policies, yous're typically required to prepay a ane-year homeowners insurance policy on the firm, plus an extra two months of premium charges to the lender's escrow account. The lender may too escrow 1 or two months of premiums for PMI as well, if required. You can find the best insurance rates past going through Policygenius– they tin can show you a number of rates and y'all can hands compare and choose the all-time ane for you.

Depending on where you live, prepaid expenses may come up to every bit much as ii% of the loan amount.

Fortunately, y'all tin can accept some or all of the prepaid expenses paid for you lot by either the seller, or past premium pricing paid to the lender. A tertiary option is to reject the escrow arrangement past the lender. This will crave that you make a down payment of at least xx%.

Utility adjustments

Utility adjustments can include a large number of charges. Luckily, they seldom come to more than a few hundred dollars. They basically correspond utility costs paid by the property seller in advance.

For example, if a seller fills the heating oil tank simply before the closing, y'all'll be required to reimburse the seller for the unused oil. This will happen at the closing tabular array. Like charges tin be incurred if the seller has prepaid other utilities, such as h2o, sewer, or trash removal.

Still another expense that could require aligning at closing are homeowners association fees. In many homeowners association neighborhoods, member fees are paid on an annual footing. If the seller has paid the fee for the full year, and you're endmost on the house on March 31 – three months into the twelvemonth – you will be required to reimburse the seller for nine months' worth of fees. There may also exist a fee to the HOA to become started. They may call it a transfer fee or something similar. Basically, it'due south a lump sum upfront from the new homeowner to get into the HOA.

Lender-required "cash reserves"

This ane takes many homebuyers by surprise. It isn't a closing expense, but lenders require that you take and so much cash left in savings after all closing costs are paid.

Lenders have a cash reserve requirement to avert a heir-apparent "closing broke". They don't want you to end upwardly in an early on-term default. This requirement ensures that the borrower will be able to make their payment during the first few months.

The most typical cash reserve requirement is two months. That means that you must accept sufficient reserves to embrace your outset two months of mortgage payments. So if your main, interest, taxes, and insurance (PITI) come to $1,500 per calendar month, the reserve requirement will be $3,000.

These are not funds that must be deposited with the lender. But the lender must be able to verify that yous volition have the funds available in a liquid source. These include savings account, checking account, or money marketplace fund – after endmost on the property. More often than not speaking, they frown on using retirement assets for this purpose, since those funds cannot exist easily liquidated.

Where to get mortgage financing to buy your home

Credible

A great place to start your search is Credible . Before you even kickoff shopping for a new home, you can find out how much of a mortgage you can afford and fifty-fifty get preapproved for that amount. Having a preapproval letter will help you gain the confidence of your real estate agent and any homebuyers since they'll come across that y'all tin can get a loan for the amount of the purchase.

What's nifty about Credible is that with i quick preliminary application, you tin go quotes from multiple lenders. That lets y'all compare rates to make sure you're getting the best interest rates and terms for your mortgage. If y'all like one of the offers, you can continue to a more all-encompassing application.

Like Reali Loans, Credible doesn't accuse fees for its services. Whatever fees y'all'll pay will be to the lender y'all cull based on the quotes Credible gives you.

Summary

If you are ownership a home for $200,000 and demand a 10% down payment, the total corporeality of cash that y'all may demand to provide or at to the lowest degree prove looks something like this:

| Cost | How much you need to relieve | Amount needed in cash |

|---|---|---|

| Down payment | 10% of $200,000 | $20,000 |

| Closing costs | 2.5% of $180,000 | $4,500 |

| Prepaid expenses | two% of $180,000 | $three,600 |

| Utility adjustments | Estimated | $500 |

| Greenbacks reserves | $ane,200 mortgage payment x 2 | $two,400 |

| Total cash required | $31,000 |

Every bit you can see, y'all could need more than 1.v times your down payment to successfully close on a business firm.

That's why it's of import to include the boosted cash requirements in your abode buying plans.

Read more:

- What Percentage Of your Income Tin can You Afford For Mortgage Payments?

- Home Affordability Calculator

Related Tools

Save Your First - Or NEXT - $100,000

Sign Up for complimentary weekly money tips to help yous earn and salve more

We commit to never sharing or selling your personal information.

Source: https://www.moneyunder30.com/how-much-cash-do-you-really-need-to-buy-a-home

Posted by: loganloyed1976.blogspot.com

0 Response to "How Much Money Do You Need Upfront To Buy A House"

Post a Comment